Mineola, NY- Nassau County Comptroller George Maragos released the 2014 unaudited fiscal results today and reported that the County is expected to end the year with a small budgetary surplus of $10.7 million in the primary operating funds. The surplus was achieved by various Administration initiatives in response to a drop in sales tax revenues. The initiatives included reducing expenses, drawing $16.2 million of prior year fund balance and borrowing $121.1 million, in accordance with the multi-year financial plan approved by the County Legislature, to pay property tax refunds, judgments and settlements, and police termination pay.

“The Administration overcame significant issues, such as a steep decline in sales tax revenues, reduced state and federal aid, and a decline in departmental revenues to end in surplus,” Comptroller Maragos said. “The increasing reliance on borrowing and use of fund balance is concerning and should be avoided. Additional structural reforms and new initiatives are needed to bring expenses in line with revenues by reducing the high levels of police overtime costs, and reversing the declining trends in departmental revenues and sales tax.”

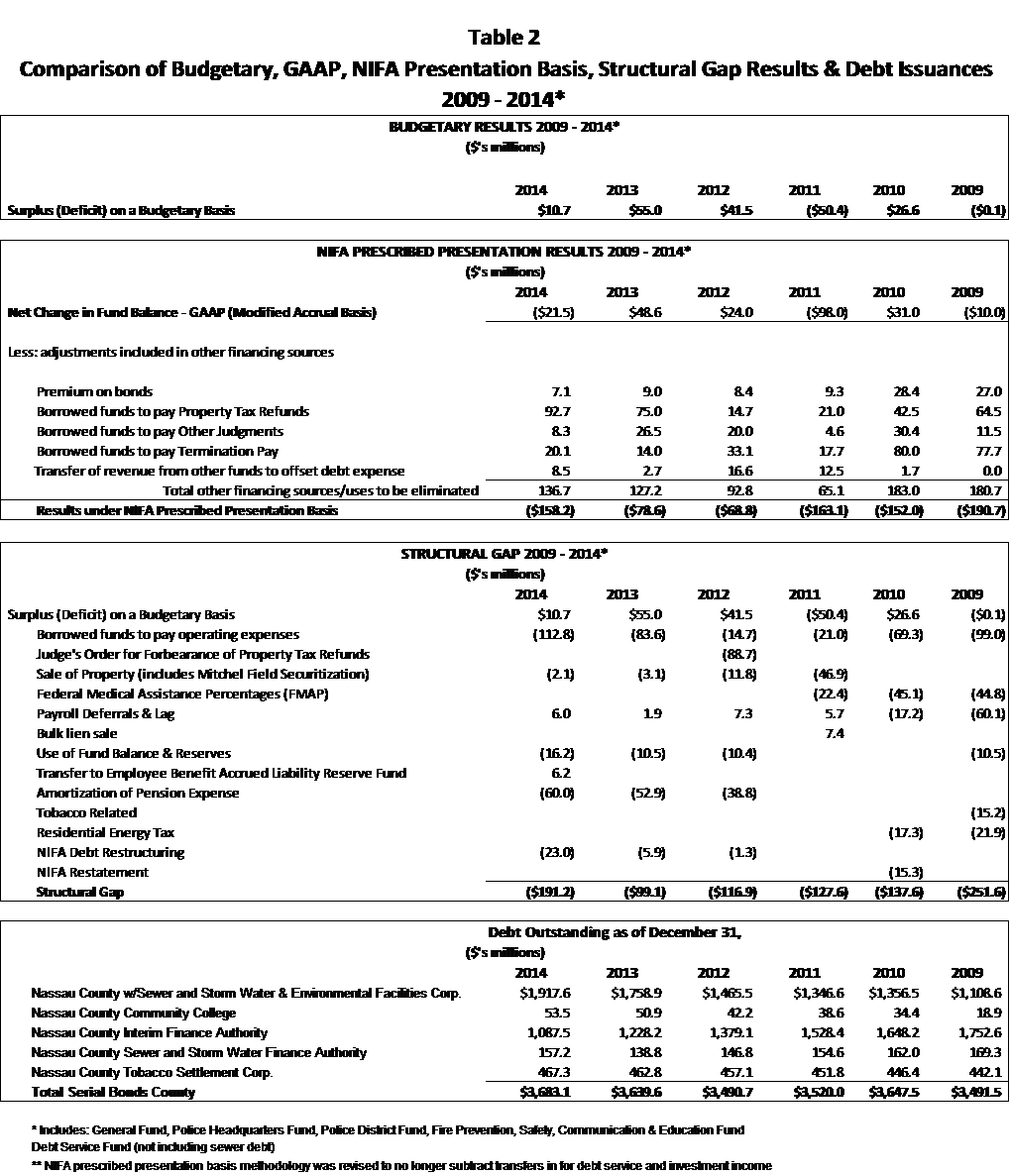

Under Generally Accepted Accounting Principles (“GAAP”), as required for governmental financial reporting, the County’s unaudited results are expected to result in a negative $21.5 million, after certain exclusions, such as the use of fund balance, pension adjustments and other adjustments. Based on the NIFA reporting methodology, the County’s year-end results are expected to be a negative $158.2 million after adjustments to GAAP as required by NIFA, to exclude certain revenue sources, such as premiums on bonds, and borrowed funds to pay for operating expenses. The NIFA result, which is more restrictive than GAAP, represents a deterioration compared to the negative $78.6 million in 2013.

The Structural Gap, which has been used historically to measure the financial health of the County, increased in 2014 to negative $191.2 million. This is due primarily to an increase in operating expenses paid with borrowed funds and the use of fund balance. The Structural Gap is the difference between recurring revenues and expenses, and excludes non-recurring items, such as certain borrowings, and extraordinary items.

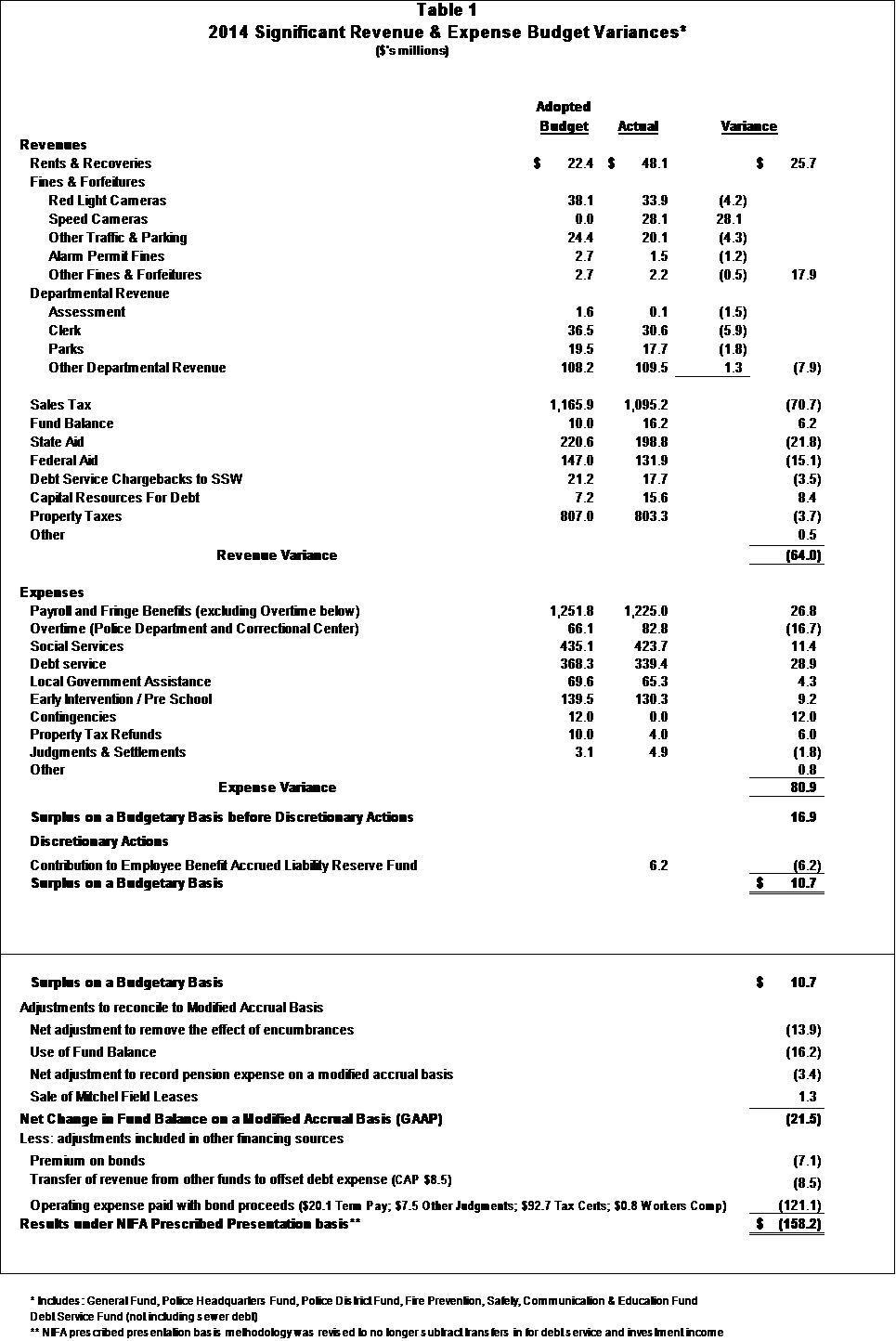

Table 1 summarizes the major variances to the 2014 Adopted Budget. Although revenues were lower than budgeted by $64.0 million, expenses were also lower by $80.9 million. The resulting $16.9 million positive variance was reduced by a discretionary action of $6.2 million for the contribution to the police termination pay reserve, in order to yield a budgetary surplus of $10.7 million. Revenues fell short primarily due to lower Sales Tax collections but were offset by $28.1 million in higher Fines and Forfeitures resulting from the speed camera program implemented in the latter half of the year. State and Federal Aid also came in $36.9 million less than expected. In addition, Departmental Revenues came in less than budgeted particularly due to lower Park fees resulting from lower park attendance, and a reduction in County Clerk fees resulting mainly from a lower volume of Mortgage recording fees.

Expenses were $80.9 million better than budgeted primarily due to $28.9 million in lower Debt Service expenses than budgeted, the use of borrowings to pay $6.0 million of budgeted Property Tax refunds, and $11.4 million in lower Social Services costs related to fewer caseloads and a lower local share in Medicaid, as well as $9.2 million in lower Early Intervention and Pre-School expenses resulting from lower caseloads, and $26.8 million in lower Payroll and Fringe Benefits. The lower expenses were offset by approximately $16.7 million in higher overtime, comprised of $17.8 million in the Police Department, offset by lower Correctional Center overtime of $1.1 million.

The $121.1 million in borrowings to fund operating expenses, in addition to borrowings for capital projects, increased the total County and its component units’ outstanding Long Term Debt at year-end to $3.68 billion up from $3.64 billion in 2013, for a net increase of 1.2% ($43.5 million), after pay down of maturing debt (see Table 2).

The estimated outstanding property tax liability was reduced to $305.4 million from $325 million. In addition, there is approximately $385 million of potential liability from certain non-certiorari tax cases dating, in some cases, to the 1990’s. The County is still making legal arguments in these matters.

“The financial fundamentals of the County have shown deterioration over 2013 caused by the decrease in sales tax revenues, and the increased borrowings approved by the Legislature as per the multi-year plan,” said Comptroller George Maragos. “Reducing borrowing and finding other sources of income should continue to be a priority for the Legislature, NIFA and the Administration in order to improve future results.”

![]()