- Home

- Government

- COVID-19 INFORMATION

- Boost Nassau Recovery Resources

Boost Nassau Recovery Resources

Boost Nassau Recovery Resources

How to Get Started

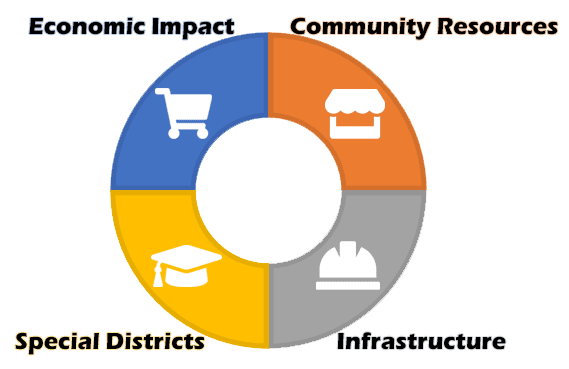

This site is your one-stop-shop for finding available resources you need to recover. Click on the tabs below to start.

- Economic Impact will bring you to programs which support businesses and non-profits, from County, New York State, and Federal sources.

- Community Resources will bring you to programs to support individuals and households.

- Special Districts will bring you to programs for Nassau County districts that perform specific functions in the community, such as fire, water, and schools.

- Infrastructure will bring you to programs to improve Nassau County infrastructure and government services.

Recovery Plan Performance Report July 31, 2023

Recovery Plan Performance Report July 31, 2022

Recovery Plan Performance Report August 31, 2021

Program | Link |

|---|---|

| Household Assistance Program | The HAP program will permanently close August 31, 2022. Applications not updated by then will be closed without further review. For assistance with your application please call the Boost Nassau Resource Center at 516-572-2888. *Effective April 1, 2022, HAP requirements have been updated to conform to US Treasury Final Rule’s income eligibility thresholds. A one-time $375 benefit for Nassau County households with annual Adjusted Gross Income of $76,050 or less; one application per household. |

| Nassau County COVID-19 Rental Assistance Program | Rental assistance payments to provide relief to households earning at or below 80% of Area Median Income (AMI) that are struggling to pay their rent due to the COVID-19 pandemic. Assistance to cover up to 3 months of rental arrears or unpaid rent as of April 2020. Payments made directly to the landlord/property owner on behalf of the tenant. |

| Local Administrators of the Federal Emergency Rental Assistance Program | Assistance provided for households earning at or below 80% of Area Median Income (AMI) to cover up to 12 months of rental/utility arrears owed on or before March 13, 2020. Up to 3 months of additional rental assistance available for households spending 30% or more of gross annual income on rent. Payments made directly to the landlord/property owner on behalf of the tenant. Residents in Nassau County will submit applications to various organizations depending on which Town or City they live in:

|

| SEPTIC Grant Program - Residents | Septic Environmental Program to Improve Cleanliness (SEPTIC) The SEPTIC program will provide grant funding to eligible recipients to replace a conventional or failing septic system with an innovative and alternative onsite wastewater treatment system. Nassau County is offering grants of 50% of the costs, up to $10,000, for homeowners or small businesses to install state-of-the-art nitrogen reducing septic systems. Contact: SepticReplace@nassaucountyny.gov Website: https://www.nassaucountyny.gov/5191/Nassau-Septic |

Program | Link |

|---|---|

| Boost Nassau County Veterans Support Grant | Nassau County is assisting Nassau County veterans support non-profits (501(c)(3) and 501(c)(19) organizations only) that have experienced a financial loss or hardship due to the COVID-19 emergency and subsequent recovery. Grants of $10,000 per non-profit will be awarded to eligible non-profits providing veteran support. Nassau County Veterans Support Grant Program |

| Boost Nassau Main Street Recovery Grant Program | Nassau County is supporting small businesses that have experienced financial hardship due to COVID – including retail and service businesses – and that are in need of financial assistance to continue to operate or be able to reopen as allowed by law during the crisis. Grants of $10,000 per business will be awarded for eligible businesses with 50 or fewer full-time equivalent employees. Eligible funding uses include commercial rent or mortgage payments. PROGRAM UPDATE: |

| Boost Nassau Nonprofit and Special-District Grant *Applications are not being accepted at this time* | Using funds from the American Rescue Plan, Nassau County is pleased to offer the Boost Nassau Nonprofit & Special-Purpose District Grant Program, an opportunity for 501(c)3, 501(c)19, and Special-Purpose Districts to strengthen their current offerings, or to develop new services and programs to serve County residents. |

| Boost Nassau Technical Assistance Grants – Chambers of Commerce/Business Improvement Districts (BIDs) *Applications are not being accepted at this time* | Technical assistance grants for local chambers of commerce and downtown business organizations to support business development, training resources, promotional activities. |

| Boost Nassau – Small Business COVID-19 Recovery Loan Program | Part of the State’s New York Forward Loan Fund (NYFLF), Boost Nassau Small Business Loan Program provides working capital loans for small businesses and non-profits with 50 or fewer full-time employees and gross revenue of less than $5 million that can demonstrate loss of income due to COVID. Eligible applicants will receive loans up to $100,000 repayable over a 5-year term at 3% fixed interest for business/2% fixed interest for non-profits, with interest-only payments during the first 12 months. Eligible funding uses include commercial rent or mortgage payments. |

| Additional Assistance for Small Businesses & Non-Profits | New York State:

|

Program | Link | |

|---|---|---|

| ELC Reopening Schools |

| |

| Special Districts - School Districts | School districts have avenues for grants and reimbursements but federal funding streams like FEMA or ESSER can be difficult to navigate and cumbersome to administer - - leaving money on the table the should go to support school districts. In order to help districts make the most of general dollars, Nassau County will now be providing consulting services to school districts. Contact: NassauSchoolRecoveryResource@nassaucountyny.gov Website: https://www.nassaucountyny.gov/5214/Nassau-School-Recovery-Resource-Portal | |

| Multi-Year Regional Groundwater Conservation Program – Water Quality Improvements Element Administration | The County is seeking applications from eligible non-profit organizations (501(c)(3)) and eligible subrecipients to receive ARPA funding to perform administration and oversight of distribution of grant funds to ensure compliance with ARPA/US Treasury guidelines. Grants up to $50,000 will be made available to each of the eligible public and private water suppliers in Nassau County to assist with costs associated with treatment and removal of contaminants. For more information: https://www.nassaucountyny.gov/DocumentCenter/View/34124/Notice-of-Funding-Availability_ARP_210819 Application: https://app.nassaucountyny.gov/ce/boost-nonprofit/ |

Program | Link |

|---|---|

| Coming Soon! |